"I'm living a nightmare and I don't know how to wake up": trapped by consumer loans, they testify

"I printed the Banque de France form, but I can't fill it in. It's too hard." Despite her 19,500 euros in credits accumulated in four years, Betty* still refuses to file a file for over-indebtedness. A single mother of three children, she is one of the thousands of French people who fight every day to keep their heads above water, despite the weight of consumer credit which is overwhelming them.

A survey of 60 million consumers, published Thursday, October 24, shows that most banks have still not lowered the amounts of incident fees for the most vulnerable, as Emmanuel Macron asked them to do. A situation that contributes to the over-indebtedness of dozens of French people who responded to our call for testimonies, like Betty.

Fighting a solitary battle

Almost nothing betrays the secret of his financial situation. The fragility of his voice hints at the burden of a daily routine that is made up only of calculations. Like the fact that she almost whispers when she talks about her situation in public. At 39, Betty constantly juggles consumer loan repayments, contracted to cope with a disrupted daily life. After her divorce, Betty had to quit her job to stop seeing her ex-husband. "I kept our accommodation, but I could no longer pay the 1,300 euros in rent. When I moved, I was forced to pay restoration costs, she explains. So I took out a loan. Then another, for a car."

The gear is engaged. Betty signs other consumer loans to pay off the previous ones. As a result, each month begins almost the same way: in the red, with an overdraft that his salary of 2,000 euros no longer covers. "I feel like I'm living a nightmare and I don't know how to wake up," she ends up slipping, detailing the sums she can no longer pay, such as electricity bills. She changed supplier after a hot water cut last month. "EDF will revive me, but I hope to find an arrangement with them," she slips.

This "fighter", as she defines herself, is forced to make choices, prioritizes rent and pushes back what can be, until it is no longer possible, such as the 700 euros of orthodontic care for her 16-year-old daughter. "It had to be done, otherwise it was too late." Betty leads this fight alone, does not confide in anyone. She just writes what's on her mind, in a little golden notebook that she keeps in her bag.

Sandra* is also careful not to reveal her dark secret. "When people pass me on the street, they must be like 'everything is going well for her'." This saleswoman in a luxury brand, "but poorly paid", must not let anything show. Playing his role with wealthy clients, with clothing concerns a thousand leagues from his own.

Don't splurge

At the age of 34, the young woman drags two consumer loans like a ball, taken out on her arrival in Paris. "My parents paid my rent, but for the rest I wanted to manage. So I borrowed 8,000 euros. I don't even know how the bank was able to grant it to me, given my income." She admits that at the time, she was not necessarily paying attention. "And don't want to eat pasta every night."

Quickly, she finds herself overdrawn, forced to take out a second loan to repay the first. The money is used for current expenses: no holidays, no restaurant, no follies. “It’s a total hassle, she laments.

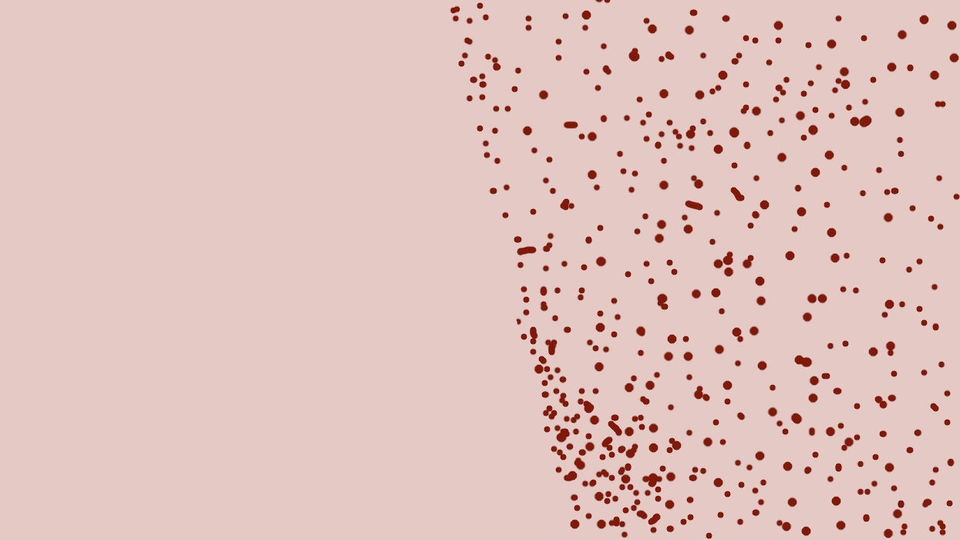

250 kilometers from Paris, in the suburbs of Le Mans (Sarthe), André has never been so alone with his loans. After the sudden disappearance of his son, his wife, and his parents, this 68-year-old retiree no longer has any prospects, except that of repaying. He has accumulated three consumer credits for ten years. A classic situation, as this note from Terra Nova explains: of the 3.6 million bank customers in a situation of financial fragility at the end of 2017, each would have an average of 3.4 consumer loans on their backs. A situation made possible by the absence of an alert when they are opened with different organizations, contrary to what the Court of Auditors demanded in 2017.

After a chaotic end to his career and an accident that left him disabled, André wanted to "change his life" by leaving his accommodation in Le Mans, where the rent was too high for his retirement. "I borrowed 5,000 euros to buy a car, a washing machine, a refrigerator." Then, unable to pay his taxes, he took out an additional loan of 3,000 euros. It's more than he needs, but "you know, you get used to having money". He easily obtained a third loan from a large supermarket chain.

His only wish now: "To get out of it, but I'm alone." He also tried to redeem his credits, to reduce the overall amount of monthly repayments and thus improve the situation. "But I can't, I'm stuck at the Banque de France." So he makes his back round and only goes out once a week, to do some shopping with his car "broken down, but which can still drive a few kilometers". The rest of the day, he spends it in front of the TV, alone in a daily life punctuated by reminders from credit organizations.

Not being able to help his children

Trapped, François is too. This retiree from Seine-et-Marne, who lives temporarily with one of his children, worries on a daily basis by monitoring his seven consumer loans. As often, it was an accident of life that precipitated this former aeronautical engineer into a nightmare. A divorce, bills piling up, an overdraft… And a first loan to make up for it. The black series leads him to live for three months in his car, "six days looking for a parking space without a streetlight to be able to sleep, eat outside, and not be able to stretch his legs. I planned in my budget one night in a Formula 1: it was like a vacation for me".

What undermines him is not being able to help his children. He has a son in engineering school. "He needed 6,000 euros for his schooling. We wanted to take out a student loan, but I can no longer be a guarantor. As a result, I was forced to take out consumer credit, one more." His wavering voice barely contains his anger against the banks. "When I had money, I was asked for investments. Now I am the black sheep."

Isabelle feels the same feeling of injustice since her new banker refuses her a small overdraft of 200 euros, which the previous one granted her. For having concluded a credit contract when she received alimony from her ex-companion, she is now strangled by the charges. Asthmatic, this 47-year-old single mother can no longer treat herself properly. "I have to pay the doctor, so advance costs before reimbursement from my health insurance, but as my overdraft is cancelled, the check risks being refused... So I'm pushing back."

Hoping to find "a normal life"

Part-time Japanese teacher in the National Education, she struggles to find hours of lessons. Isabelle only has her relatives to help her. "From the 8th of the month, I have nothing left. This week, I found a good offer of chicken in a supermarket, so we eat a lot of chicken. Luckily my son goes to my parents to vary the menu. " Her hope is to meet someone who will help her get back on her feet. "I'm in good faith, I pay my debts, I don't want to take advantage of the system, she defends herself. I just want to have a normal life."

Alexandra* barely sees the end of the tunnel. Thanks to Crédit municipal de Paris, this 67-year-old retiree submitted an over-indebtedness file to the Banque de France. It was by constituting it that she became aware of the extent of the added loans: 35,000 euros in total. "I was like an ostrich, I didn't want to see. It was a form of denial. I can't explain it," she confides. A credit contracted after a dismissal, to offer Christmas gifts to his children, then another.

Extensions have been added, suggested by the establishments with reminders. "If I have credits, it's not to pay for trips, a car or a sofa," she defends herself. It was for my daily life. "They offered me to release money in 48 hours. It was the easy way out," breathes this former executive secretary.

Reimbursements were sustainable when she was working, but her retirement pension is no longer enough. "Before, I had regular bonuses that allowed me to get back on my feet. Now, I have nothing left, apart from my retirement." As a result, Alexandra no longer goes out and invents excuses to refuse invitations. Like Sandra, she leads a double life. Impossible to guess the financial abyss which is his. However, she lives with "a lump in her stomach every time [she] opens the mailbox, the fear of seeing a bailiff arrive."

When Alexandra finally took the plunge and put together her over-indebtedness file, the Crédit municipal de Paris teams advised her to discuss her situation with her children. "To confess to them freed me from anxiety, from fear of their reaction. It was a real relief." Today, she breathes and regains hope, without forgetting the gears that almost crushed her. "It can happen to anyone," she insists.

* The first names have been changed at the request of the witnesses.