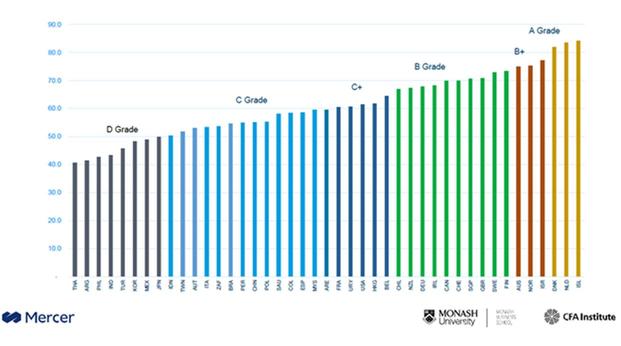

Pension level: comparison of pension differences depending on the country

Mercer CFA Institute Global Pension Index (MCGPI)

Now is not the time to slow down the pension reform, it must rather be accelerated!

In particular to fill the pension differences between women and men observed in all countries.

What you must remember

The impact of the COVID-19 pandemic continues to affect the well-being of millions of individuals in the world.Its effects are not limited to health systems or people who contract the virus.Many countries have indeed increased their public debt and had to reduce their economic activity.If most have reacted by important recovery measures, socio-economic inequalities around the world have never been so glaring.Particularly impacted, retirement systems participate in this trend by exacerbating in particular inequalities between women and men.This problem, inherent in each system, is not, however, inevitable and concrete solutions can be implemented. Mercer, leader mondial du conseil en ressources humaines et spécialiste en Retraite & Investissement, fait le point en dévoilant les résultats de son rapport annuel sur les systèmes de retraite à travers le monde2.

The Mercer CFA Institute Global Pension Index (MCGPI) results from an exhaustive annual study comparing retirement systems worldwide.It makes it possible to identify their weaknesses and to define reform avenues to guarantee a sufficient level of pension and a lasting financial balance.

This 2021 edition was led by the CFA Institute, the World Association of Investment Professionals, in collaboration with the Monash Center for Financial Studies (MCFS) and Mercer.

This year, the overall pension index compares 43 retirement systems worldwide and thus covers two thirds of the world's population.It uses the weighted average of performance, viability and integrity 3 to assess each pension system according to 50 indicators.The three best rated countries have all received note A and are financially solid and well managed systems, while paying sufficient income for retirees.

Socio-economic inequalities exacerbated by the pandemic

For Margaret Franklin, President and CEO of the CFA Institute, it is imperative to identify levers to improve retirement benefits: “The pandemic has exacerbated socio-economic inequalities in many regions of the world.From a long -term investment point of view, we are evolving in an extremely difficult environment, with historically low interest rates and, in some cases, negative yields that clearly have an impact on financial products ".

"Another major problem is the gap that remains between the pensions of men and those of women.A situation that represents an urgent additional challenge.Also, more than ever, the promise of a safe retirement depends on the collective action of political decision -makers and stakeholders in the sector to examine the strengths and weaknesses of retirement systems, in order to offer better services toeach individual, ”she adds.

The main author of the report, Dr. David Knox, Senior Partner at Mercer, shares this observation, affirming that it is essential that actors in the pension sector act now.

"Governments around the world reacted to the COVVI-19 crisis by important economic recovery measures, which increased public debt, thus reducing their future possibilities to support their elderly population.Retirement plans around the world are increasingly moving towards retirement savings plans (defined contributions), to the detriment of traditional regimes (with defined benefits).Despite these challenges, now is not the time to brake on pension reform, it must be accelerated rather.Individuals must take responsibility for their own retirement income more and more, but they need solid regulations and governance to be supported and protected, ”he analyzes.

“In France, the pension reform was stopped clear by the COVVI-19 crisis, the priority having been given to support for the economy.The upcoming deadline for the presidential election leaves little doubt about the conduct of such a reform under this five -year term, even though it constituted a promise of candidate Macron in 2017.A structural overhaul, however, seems necessary to preserve the French model by distribution.This is accompanied by a growing empowerment of companies and French people who, to improve their income once retired, are increasingly turning to retirement savings, ”comments Christel Bonnet, Director Consulting Transition Retirement at MercerFrance.

Disadvantaged women in terms of retirement compared to men

One of these days im gonna make an inuoka rp account

— ness 🌼 Sun Sep 20 19:42:00 +0000 2020

Fill the gap between the pensions of men and those of women supposes to meet two related but distinct challenges: reduce poverty in the elderly - a more frequent phenomenon in women - and stem the inequality that exists between the two sexes inemployment (and therefore in contributions paid for a retirement pension).

"Our study shows that the reasons for this gap are diverse according to the regions studied, there is no single cause.In each country, employment problems, the design of pensions as well as to socio -cultural problems contribute to that women are much more disadvantaged than men in terms of retirement pension, ”comments Dr. Knox.

If the problems linked to employment are important and well -known factors - more women work part -time, undergo periods of inactivity to take care of children, earn average wages lower than men...- the study reveals that the rules applied by pension plans aggravate the problem.These include the allocation of non -compulsory retirement rights during parental leave, the lack of acquisition of rights to a pension during the care of young children or elderly parents in most countries, or the lack of indexing of pensions during retirement, which has a greater impact on women because of their longer life expectancy.

In this line, in France, women receive an average retirement income 28% lower than that of men (€ 1,399 gross monthly versus € 1,947).In the general pension plan (employee regime in the private sector), women benefit from a few mechanisms for compensating periods of work stoppage to raise young children (children of children's increases, quarters during periods of leaveparental and increase in pension amounts).However, these measures do not protect from a reduction in the amount of pension (ex.: non-acquisition of Agirc-Arrco points).Women, who are mainly caregivers for the elderly or disabled, do not acquire any rights to retirement for the time spent supporting fragile people.

"Retirement players can take a number of measures.To start, they must remove the restrictive eligibility conditions for people who wish to join employment regimes related to employment.Each individual should have the right to participate in a pension plan regardless of their salary level, regardless of their employment rate or seniority, in order to allow them to build up sufficient pension.Pension funds can also assign pension rights for people who deal with young children and the elderly.Caregivers do a precious service to the community and should not be retired for having taken time outside of professional activity, ”concludes Dr. Knox.

The 2021 edition in figures

Iceland obtains the highest overall index value (84.2), followed closely by the Netherlands (83.5).Thailand has the lowest index value (40.6).

The index uses the weighted average of the performance, viability and integrity sub-indexes.For each sub-index, systems with the highest values are Iceland for performance (82.7), Iceland for viability (84.6) and Finland for integrity (93.1).The systems presenting the lowest values for all sub-indices are India for performance (33.5), Italy for viability (21.3) and the Philippines for integrity (35,0).

Compared to 2020, China and the United Kingdom are the countries that have progressed the most.The effects of their previous pension reform begin to observe themselves in 2021: Improvement of pensions for individuals and pension regulations.

France remains in an average position.The strength of its compulsory pension system is to allow retirees to receive a decent income once retired, while long-term financial balance remains extremely fragile (function of demographic balance and economic growth) andthat this system is difficult to understand in the eyes of the French.A reform simplifying the system and allowing financial rebalancing could improve the positioning of France according to the criteria of the MCGPI index.

1 Directorate of Research, Studies, Evaluation and Statistics (DREES) - figure 2020.

2 For more information on the Mercer CFA Institute Global Pension Index, click here.

3 Definition of the 3 main criteria:

- Performance: Criterion measuring the standard of living of retirees;

- viability: criterion measuring the long -term financial balance of pension plans;

-Integrity: criteria measuring transparency towards assets/retirees on the operation of pension plans.